That first glance at a trading platform can be a strange experience. It’s a screen full of lines, numbers, and words that seem to assume you’re already in on the joke. You might see “liquidity” or “RSI” and feel a strong urge to just close the tab and forget the whole thing.

This initial confusion is the biggest hurdle. The idea that you need to start making money right away often leads to rushed decisions. A better way is to ignore the pressure to perform and just find a comfortable place to learn the language. Luckily, several platforms now act more like patient guides than intimidating gatekeepers. They are built with the total novice in mind, offering a gentler on-ramp to a complex world.

Your Training Squad: Platforms That Speak Your Language

Think of these platforms as different types of coaches. Each has a unique style for getting you from the sidelines into the game.

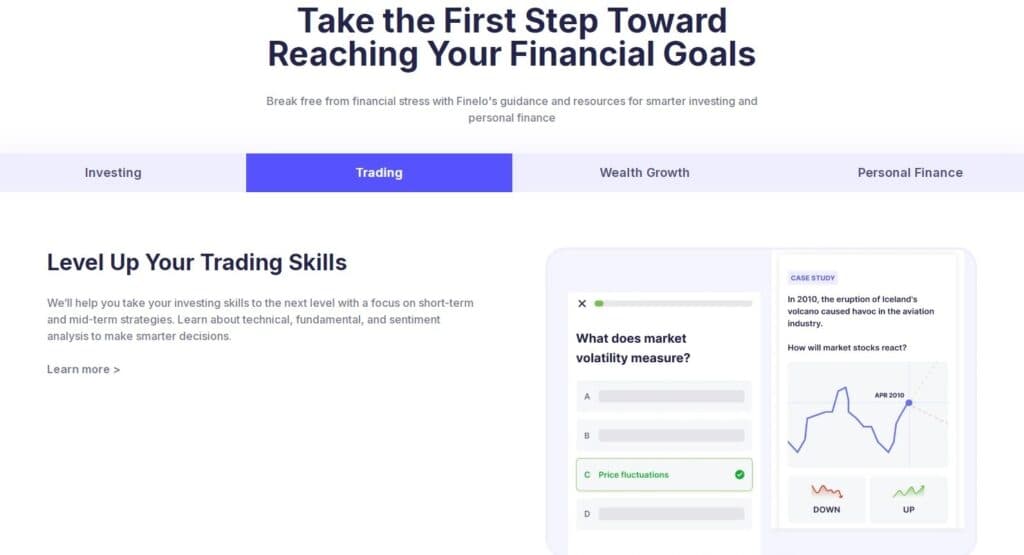

Finelo: The Patient Tutor

Finelo.com operates on a simple idea: you can’t run before you can walk. This platform is built for the person who finds terms like “ETF” or “bid-ask spread” mildly terrifying. It’s less of a trading app and more of a dedicated financial dojo.

The heart of the experience is its investing simulator. You get a virtual portfolio funded with play money to test strategies against live market data. This isn’t a simple game; you have access to interactive charts, over 120 assets, and tools like a TradingView widget. The key here is the consequence-free environment. Making a bad trade and seeing your virtual balance drop teaches you about risk in a way a textbook never could, but without the sleepless nights.

The learning part of Finelo moves away from long, overwhelming lectures. It takes its 150 hours of material on topics from crypto to personal finance and splits everything into short, interactive blocks.

You might find yourself taking a quick quiz, tackling a daily challenge, or following a 28-day program that structures your progress. If a concept doesn’t stick, an AI mentor is available to provide immediate explanations and clarify things as you go.

The platform uses streaks and leaderboards to keep you motivated, turning the often lonely task of financial education into something with a sense of progress and community. It’s designed to make you feel financially fluent, one clear, manageable lesson at a time.

eToro: The Social Mentor

eToro reimagines trading as a collective activity rather than a solitary one. For a beginner, its most powerful feature is undoubtedly CopyTrading. This tool lets you automatically mirror every move of experienced investors you choose to follow.

You can browse hundreds of user profiles, dig into their historical performance, risk scores, and current portfolios, and then, with a click, allocate some of your own capital to copy them. It’s a practical masterclass in strategy, allowing you to learn by observing proven tactics in real-time.

The entire platform is designed around this community-first concept. Your feed resembles a social network, filled with updates from other traders, their market analysis, and discussions on current events. This transparency demystifies the decision-making process. Instead of wondering why a pro bought a certain stock, you can often see their posted rationale right there.

The interface itself is visually intuitive, prioritizing clear graphics and simple navigation over complex terminal windows. While it offers charts and data, the initial experience is curated to feel more about discovery and connection. eToro is for those who learn best by watching others and want their first steps in the market to feel supported by a crowd, not faced alone.

Interactive Brokers: The Technical Drill Sergeant

Interactive Brokers (IBKR) is the platform you graduate to when you’re serious about understanding the machinery of the markets. It has a reputation for being a tool for professionals, but its paper trading account is one of the most powerful and generous learning tools available to any dedicated beginner. This demo gives you full, unrestricted access to the platform’s entire suite of professional tools, but funded with virtual money.

We’re talking about real-time streaming data from global exchanges, advanced charting with countless technical indicators, and the ability to practice with complex order types. This is not a simplified tutorial; it’s the real deal.

The learning curve is steeper, without a doubt. You will need to spend time configuring the layout and understanding the terminology. However, for a type of learner who isn’t intimidated by detail and wants to understand the “why” behind every tool, there is no better practice environment.

Using IBKR’s paper trading is like learning to fly in a full-motion flight simulator. It’s complex and can be overwhelming at first, but the depth of skill you build prepares you for real-world conditions in a way a basic app never could.

Webull: The Data Analyst

Webull sits in a useful middle ground. It feels more straightforward than a professional terminal but gives you more to work with than a barebones entry-level app. It’s a good fit if you’re the type who likes to look at a chart and understand the reasons behind its movements.

You can jump into its paper trading feature without any hassle. The real strength of the app, though, is how it hands you the tools to dig deeper. Right away, you can mark up charts, add technical indicators, and see how different patterns unfold. All of this happens inside a layout that is clean and doesn’t get in its own way.

The app also feeds you a live stream of news and analysis, putting the information right next to the charts it affects. This setup encourages you to piece things together for yourself rather than just following a tip. Instead of just copying someone else, you’re encouraged to look at a chart, read the news, and make an informed decision in your paper trading account. The platform feels like it’s built for someone who learns by doing and seeing.

Webull gives you the keys to a very capable analytical toolkit, wrapped in a package that doesn’t make you feel like you need a finance degree to open it. It’s the ideal training ground for developing your own analytical eye.

How to Start Without the Shakes

Knowledge is useless without a plan to apply it. Before you even think about real money, your entire focus should be on building a routine around practice.

Open a demo account on one of these platforms and fund it with virtual cash. Treat this pretend money as if it were your own. The point isn’t to become a paper millionaire; it’s to make mistakes and learn from them in an environment where those mistakes don’t cost you anything. Get used to the feeling of placing an order and watching the market move against you. This is where you learn to manage the emotions that derail most new traders.

Set a firm daily loss limit for yourself, even in the demo. If you lose, for example, five percent of your practice capital, step away for the day. This builds the crucial habit of knowing when to stop. Combine this practice with the educational courses inside Finelo or the community watchlists on eToro. The goal is to make your first real trade feel like just another day of practice, just with different stakes.

Wrapping Up: Trading is a Marathon

The allure of a quick profit is a trap. Consistent trading comes from consistent learning. The platforms we’ve looked at work because they shift your focus from making a fortune to building understanding.

Your progress depends more on your patience than on your initial capital. Use the simulators, absorb the lessons, and learn to spot your own mistakes in a safe space. The confidence you build this way is the only thing you can truly take to the bank. Find the platform that matches how you like to learn, and focus on the process. The rest will follow.